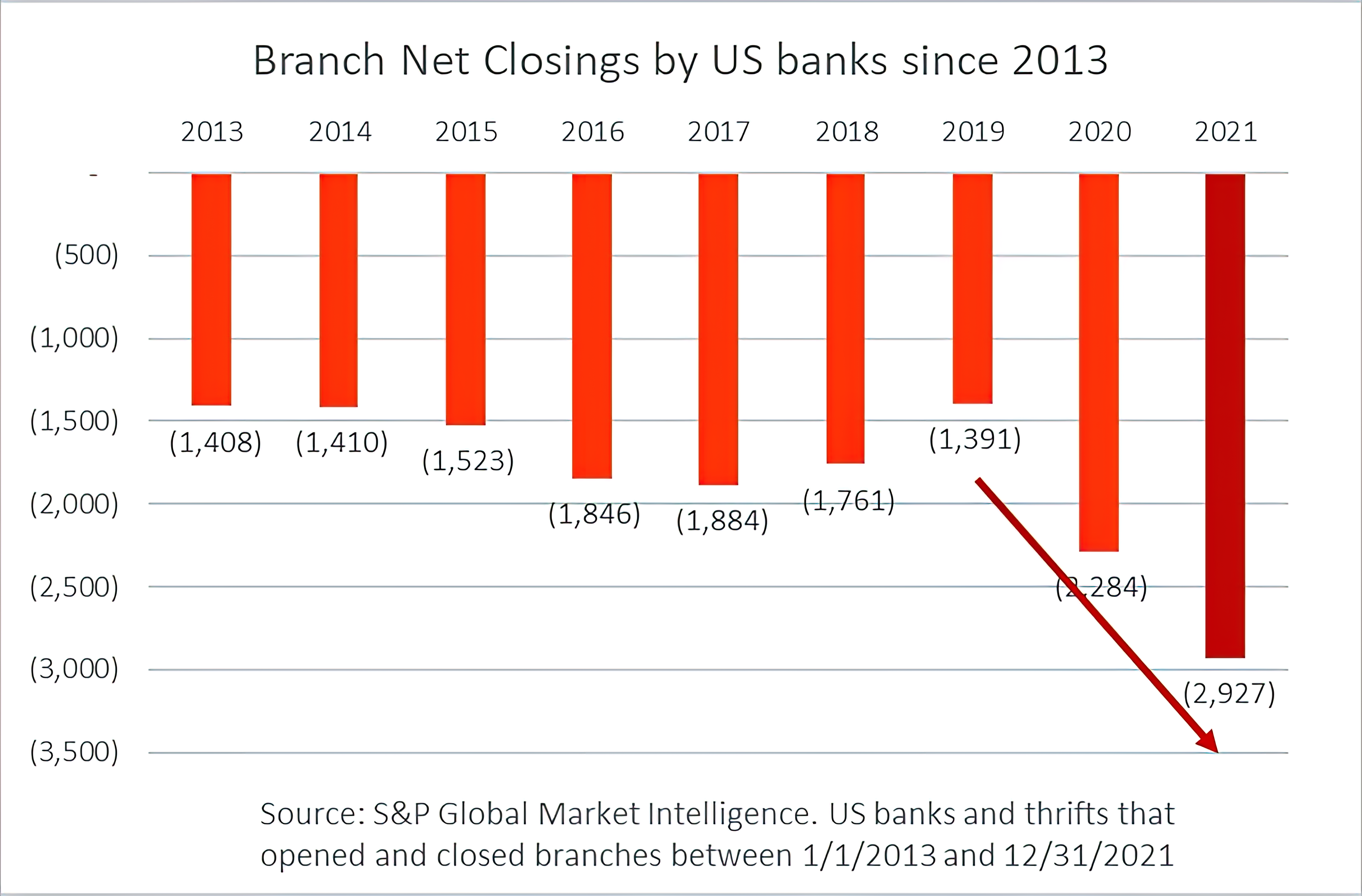

Branch Closings Accelerate as Customers Fully Embrace Digital

Physical banking footprint in the US declines by 4%

A few weeks ago, S&P Global Market Intelligence released its updated tally of bank branch counts. The numbers are stunning: US banks closed a record number of branches in 2021, exceeding the previous record pace set in 2020. And, while the physical banking footprint in the US has been steadily declining for years, the large number of net closures against a decreasing denominator of remaining branches yielded an even more surprising fact: the branch footprint in the US declined by 4% in 2021. Stat That!

What is going on in retail banking, and why are branches being shuttered at a record pace? An analysis of management commentary in recent quarterly earnings calls reveals a sea change in how bank executives view their branch networks. It’s clear the time has come to challenge long-standing myths about the role that branches play in customer acquisition and retention.

Myth #1: Closing a branch means losing customers and deposits to the competition

New Jersey-based OceanFirst Bank, with $12B in assets, has first-hand experience with branch closures and how they impact customers and deposits. At an August Investor’s Day last summer, the bank unveiled plans to reduce the bank’s footprint by an astounding 34% with plans to eliminate 20 of their 58 branches. The plan even included selling two branches to a smaller bank nearby, $2.4B asset First Bank.

An OceanFirst Regional President shared metrics on the bank’s experience with 56 branch closures and consolidations over the previous four years. The bank was able to retain over 90% of its deposits and customers, compared to an average 94.8% retention rate for non-consolidating branches. With such a robust retention rate, CEO Christopher Maher positioned the bank’s forward-looking strategy as one of leaning into digital expertise and efficiency to transform the banking experience for their customers.

Myth #2: Branches are the best and only way to open new accounts and grow relationships

Atlantic Union, a $20B asset bank based in Richmond, VA, is also among the most aggressive branch closers, having consolidated 25% of its network since 2020. John Asbury, President & CEO, remarked on the bank’s Q421 earnings call in late January that the closures reflect “our recognition of changing consumer behaviors, never-better analytics on customer usage of the branch network and alternative delivery channels, and our need to continue to invest in our digital products.” As evidence that they had not missed a beat despite the reduced physical footprint, he shared metrics showing online checking account originations jumping from 13% to 28% of total originations over the preceding 12 months. “We’ve learned to work differently, and our customers have learned to bank differently,” he said.

Myth #3: Customers will still come to the branch for complex products, such as personal loans and mortgages

In early 2021, KeyBank CEO Christopher Gorman announced that the bank would be shuttering over 70 branches, shrinking its total network by about 7%, remarking, “this is really in response to how our customers want to do business with us.” The bank provided further insight when Jamie Warder, Chief Digital Officer, revealed that they had seen a nearly 2x increase in digital loan originations in December 2020 as compared to 2018.

The bank’s full-year results from 2021 were even more impressive: the bank grew net new households at a record pace and experienced record loan originations. That included what Gorman described as very strong growth with younger clients, with 25% of the bank’s new households being under age 30. In January, KeyBank reiterated that they would continue to make meaningful investments in digital to drive future growth.

Fact: It’s time to invest more in your digital channel

It’s hard to ignore the significance of these results and the change in thinking. With branch operating costs estimated at between the high six to over seven figures per year, these case studies explode the convention wisdom of continued investment in the physical network. If your goals in 2022 include opening new accounts, growing customer relationships, and driving applications in personal loans and home lending, an investment in digital pre-sales capabilities will pay significant dividends. Leadfusion can help you deliver these capabilities and results. And that’s no myth.