The Battle for Deposits

In its continued effort to combat severe inflation, the Federal Reserve raised the target range for the federal funds rate in November by 75 basis points to a target range of 3.75%-4%, marking the sixth consecutive rate hike and the fourth straight three-quarter point increase. These unprecedented moves have caused many financial institutions to play defense in order to prevent […]

Digital Natives: Speaking Their Language

The term “digital natives” is credited to author Marc Prensky, who in 2001 wrote about the pressing need for different teaching methods for engaging students who had grown up with digital technology. Prensky observed that these K through college students (who would now be 26 – 40 years old) had spent twice as much time playing video games as […]

Financial Wellness: Small Business

Despite what the Fed and Wall Street may be thinking, small businesses are not bullish about the near-term future. Results from the CNBC|SurveyMonkey Small Business Index for Q3, released in early August, revealed that a majority consider the economy to be “poor”, with even more believing that a recession has already arrived. Caught between increasing costs, supply chain issues, […]

Inflation is Chipping Away at Household Savings

Aa inflation has reached a 40-year high, more Americans are drawing down on the estimated $2.5 trillion in extra savings they accumulated since the start of the COVID-19 pandemic. Household budgets are strained as wages have not kept pace with surging prices for everything from gas to food to rent. According to Federal Reserve data, The U.S. personal savings […]

Sideways?

The year started off promisingly, with investment pundits predicting that the economic growth seen in 2021 would continue. In an early 2022 message to clients, David Donabedian, Chief Investment Officer of CIBC Private Wealth Management, was optimistic: “we expect solid growth for the year as a whole.” However, rising interest rates, inflation, ongoing health concerns and global conflict have […]

Anchors Aweigh

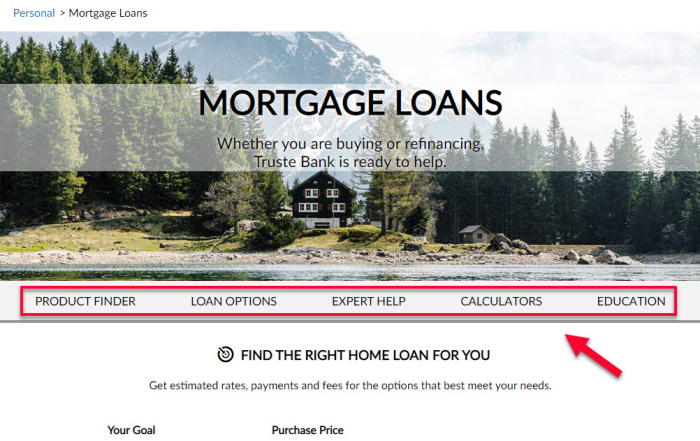

Let’s face it: visitors to your web site are increasingly impatient. They skim content instead of methodically reading it. If they cannot easily find the information that they are looking for, they will bounce quickly. First impressions matter. According to Contentsquare’s latest Digital Experience Benchmark Report, financial services website visitors in 2021 scroll only 54% of pages, down from […]

Spring4Shell Plagues Industry

Leadfusion, has been investigating the new security issue now commonly referred to as “Spring4Shell” and more technically referenced as CVE-2022-22963 and CVE-2022-22965.

Leadfusion has completed its preliminary investigation and determined that our products are not impacted by these vulnerabilities. As this is an evolving situation, Leadfusion will be continuing to monitor the Spring4Shell vulnerability. We advise all of our clients […]

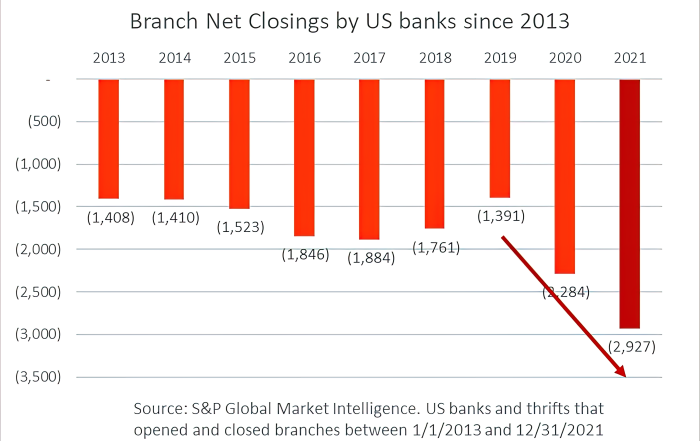

Branch Closings Accelerate as Customers Fully Embrace Digital

A few weeks ago, S&P Global Market Intelligence released its updated tally of bank branch counts. The numbers are stunning: US banks closed a record number of branches in 2021, exceeding the previous record pace set in 2020. And, while the physical banking footprint in the US has been steadily declining for years, the large number of net closures […]

Year-over-year Increase in Cash-out Refinances Signals Opportunity

Homeowners used cash-out refinances to take advantage of record levels of home equity according to Black Knight’s December 2021 Originations Market Monitor report. Home prices nationwide and new cash-out refinances were both up an impressive 18% year over year.

For borrowers that have enough equity in their home, a cash-out refinance can help lower their mortgage payment, provide funds for home […]

Log4j Vulnerability in Calculator Providers

The Log4j vulnerability has been headline news across the Internet, a veritable 5-alarm fire for security professionals. Discovered late last month by a security researcher at Alibaba Cloud and reported to the Apache Software Foundation, companies are scrambling to understand their exposure and install fixes.

The flaw in Log4j creates a remote code execution vulnerability. This type of vulnerability allows […]