Retail Banking Without Branches: 7 Critical Elements of the New Reality

In the blink of an eye the world of retail banking has changed. Traditional branch banking, long a pillar of the sales strategy for financial institutions, has all but disappeared. Furthermore, consumer habits and behavior have permanently changed. When the current health crisis is finally behind us, we will not be returning to the high-touch world of the recent […]

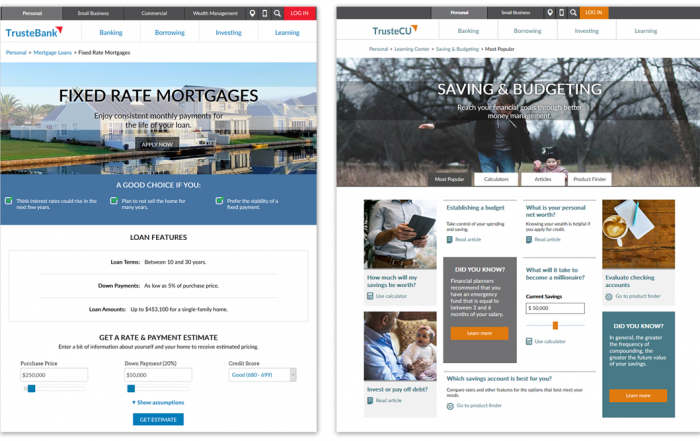

Financial Website Design for a Digital-First Era

We recently launched two new demonstration platforms – trustebank.com and trustecu.org – that bring many of best design principles to life. Let us show you how to quickly pivot to a P2P relationship from your digital self-service branch, create new digital journeys that sell, and compete in the world of digital-first. To request a guided tour, please contact your account […]

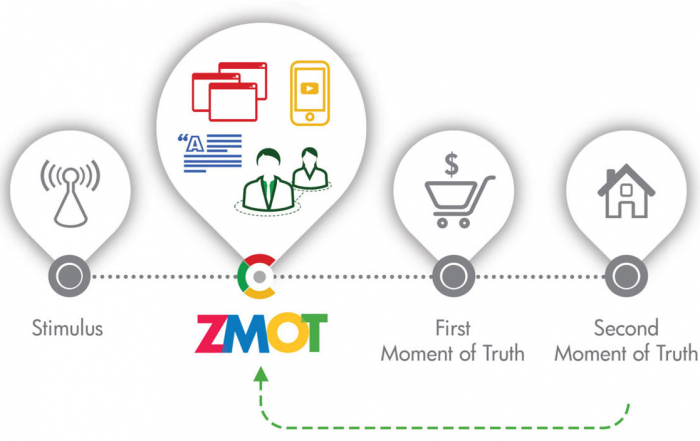

“ZMOT” and Financial Services

In 2011, Google introduced Zero Moment of Truth, or ZMOT, which described, “a revolution in the way consumers search for information online and make decisions about brands.” Google argued for being present at the exact moment a consumer had a need to fulfill. The approach seemed to follow Woody Allen’s advice: “showing up is 80% of life.” Of course, because […]

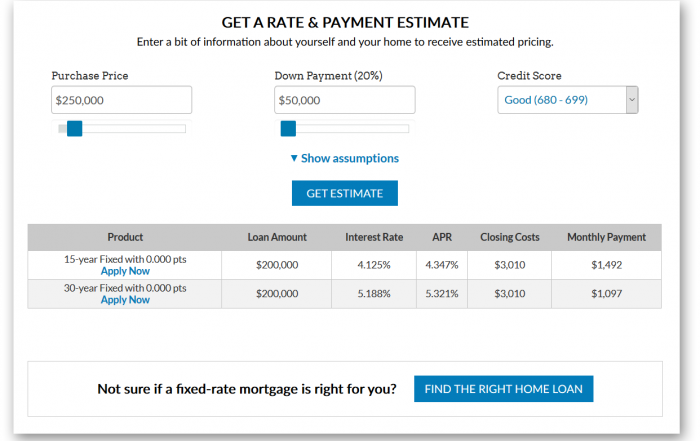

Did You Know? – Guided Selling® Streamline Mode

While most customers or prospects visiting your website need help in determining the right product for their needs, a certain segment know exactly what they want and are seeking a quick pricing estimate. For this audience, consider using Guided Selling in streamline mode – a single page experience that presents personalized rate and payment information on product pages. Contact your […]

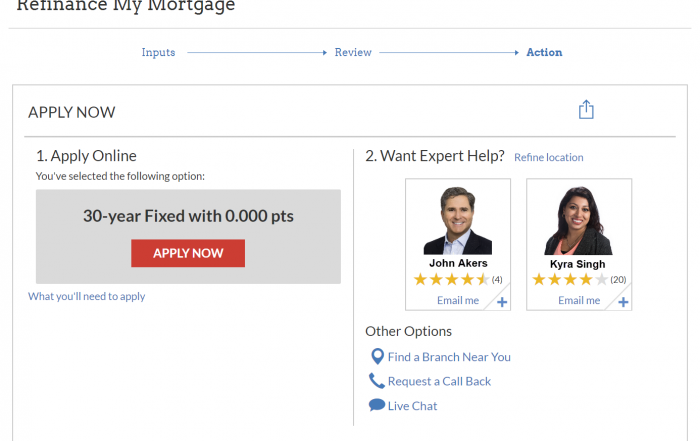

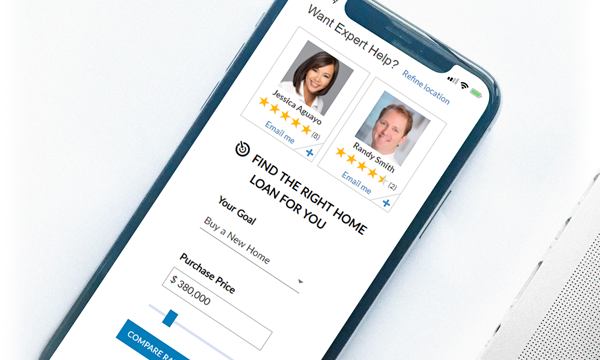

New Banker Features Now Available in Guided Selling

Our Guided Selling® solution is packed with extra features that help accelerate the connection between visitors to your digital channel and your financial service representatives in the branch and contact center. In addition, new collaborative tools help bankers improve their sales execution and follow-up. Contact your account representative for more information. […]

Leadfusion Sponsoring the Small Biz Banking Conference

Leadfusion is the proud sponsor of the upcoming Small Biz:Banking Conference, to be held in Los Angeles, CA, November 19-21, 2019. Stop by and say hello!

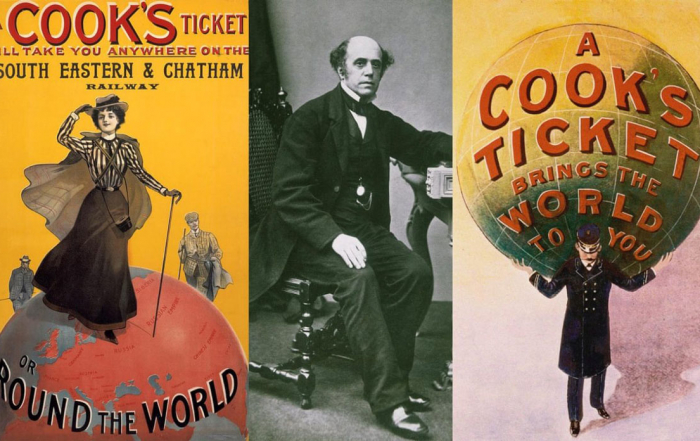

What Retail Banking Can Learn from Thomas Cook’s Demise

The news over the weekend of the venerated consumer brand that had been operating for over 178 years abruptly going bankrupt really caught our attention. The headlines blamed high debt load, a disastrous merger, and the one-two punch of bad weather and Brexit for the failure of the world’s oldest travel company. But a deeper examination of the facts in […]

New Mortgage Calculators Available

Leadfusion’s library of calculators and financial tools are the most comprehensive and configurable in the industry, nonetheless we regularly add features and update our inventory of financial calculators and tools to meet the evolving needs of our clients. Recently, we’ve added two new tools that help consumers better estimate their monthly payment on Federal Housing Administration (FHA) and Department of […]

Your Customers Want to “BOPIS,” Can You?

Back over the holidays (remember way back when, ten weeks ago?) an interesting stat floated across our desk. It really caught our attention and stood apart from the annual blizzard of holiday e-commerce shopping stats: Adobe Analytics reported that the number of buy online, pickup in-store (“BOPIS”) orders for the holiday period jumped 47% YoY. Business Insider noted that “Retailers […]

2019 Tax Law Updates

Leadfusion announces the completion and deployment of all tax law changes for 2019. Each year, as changes are made to tax law, all revisions are thoroughly reviewed by our finance team and any required changes are incorporate into our calculators, tools, and educational content. These may include default values, limits, educator information, calculation methods, etc. Customers automatically receive these updates […]